Long Term Capital Gains Tax 2020

Long Term Capital Gains Tax 2020. For the 2020 to 2021 tax year the allowance is £12,300, which leaves £300 to pay tax on. Your gains are not from residential property. Capital gains tax applies to both individuals and businesses. Capital gains tax is a levy on the difference between an asset's purchase price and sale price. This long term capital gains tax on shares might probably discourage the investors.

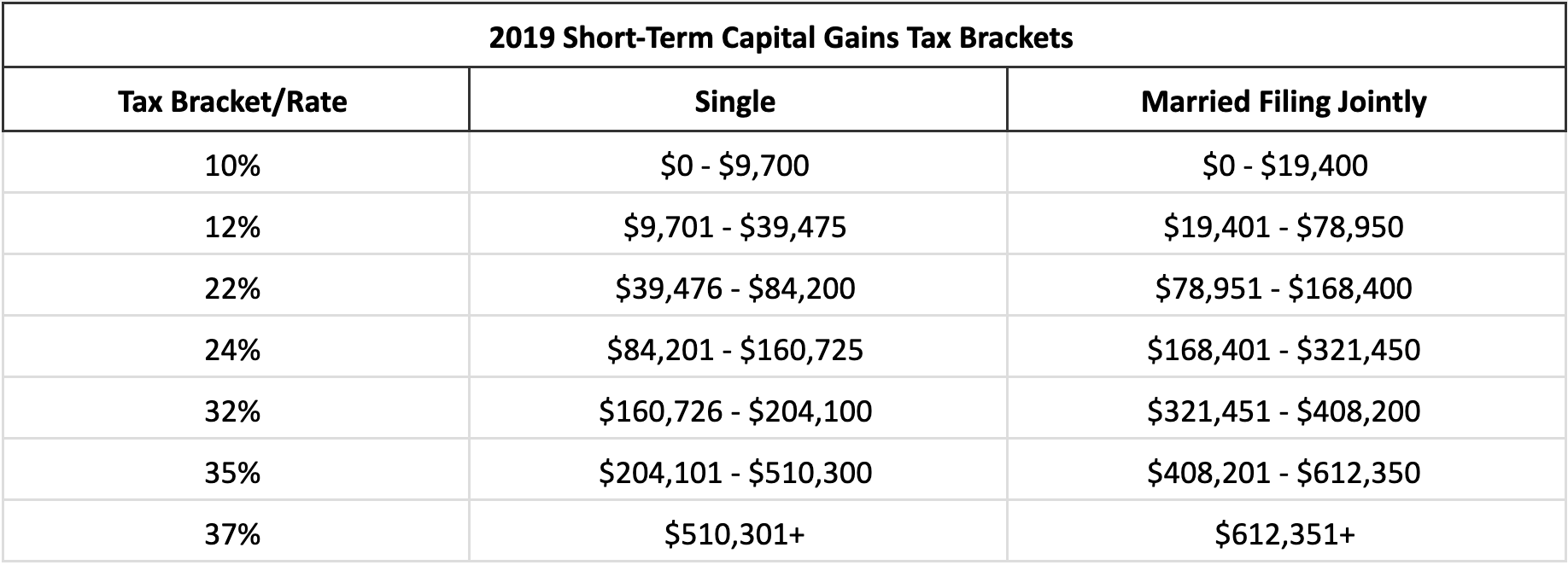

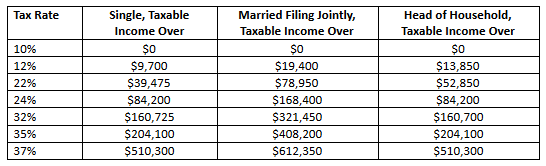

Below, the percentage of taxes paid are listed on the left with the corresponding income on. The capital gains tax rate for tax year 2020 ranges from 0% to 28%. Rates range from 0% to 37%, depending on your tax bracket and the length of time the asset was held. For the 2020 to 2021 tax year the allowance is £12,300, which leaves £300 to pay tax on. If an asset has been held for longer than a year. Capital gains tax is a levy on the difference between an asset's purchase price and sale price. Quick and easy guide on capital gains. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. How capital gains are calculated.

It relies on the fact that money you lose on an investment can offset your capital gains on other investments.

The capital gains tax rate for tax year 2020 ranges from 0% to 28%. 2020 has new capital gains taxing on long term holdings where an income less $40,000 pays 0% on capital gains, and anything income between $40,000 and appx $430,000 pays 15% on capital gains. Capital gain distributions are taxed at various rates. Capital gains tax applies to both individuals and businesses. Your gains are not from residential property. What capital gains tax (cgt) is, how to work it out, current cgt rates and how to pay. For the 2020 to 2021 tax year the allowance is £12,300, which leaves £300 to pay tax on. Quick and easy guide on capital gains. Comparing capital gains tax proposals by 2020 presidential candidates. Some or all net capital gain may be taxed at 0% if your taxable. They are taxed at rates of 0%, 15%, or 20%, depending on the investor's. In this episode, we break down short term. Requires only 7 inputs into a simple excel spreadsheet.

Comparing capital gains tax proposals by 2020 presidential candidates. If an asset has been held for longer than a year. We've got all the 2020 and 2021 capital gains tax rates in one place. Your gains are not from residential property. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. Capital gains taxes are paid when an asset is sold, and are applied to the amount of appreciation on the asset from when it was bought to when it is sold. Any profit or gain that arises from the sale of a 'capital asset' is a capital gain.

If you had purchased that same stock of your favorite company but.

If you had purchased that same stock of your favorite company but. This long term capital gains tax on shares might probably discourage the investors. How capital gains are calculated. Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual fund, or bonds. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property. Any profit or gain that arises from the sale of a 'capital asset' is a capital gain. Comparing capital gains tax proposals by 2020 presidential candidates. There are also special cases when an individual is charged at 10% on the total capital gains; If an asset has been held for longer than a year. We've got all the 2020 and 2021 capital gains tax rates in one place. For the 2020 to 2021 tax year the allowance is £12,300, which leaves £300 to pay tax on. Requires only 7 inputs into a simple excel spreadsheet. Capital gain distributions are taxed at various rates. Some or all net capital gain may be taxed at 0% if your taxable.

2020 has new capital gains taxing on long term holdings where an income less $40,000 pays 0% on capital gains, and anything income between $40,000 and appx $430,000 pays 15% on capital gains. Capital gains tax is a levy on the difference between an asset's purchase price and sale price. An aspect of fiscal policy. What capital gains tax (cgt) is, how to work it out, current cgt rates and how to pay. Some or all net capital gain may be taxed at 0% if your taxable. Quick and easy guide on capital gains. Capital gain distributions are taxed at various rates. Below, the percentage of taxes paid are listed on the left with the corresponding income on. Rates range from 0% to 37%, depending on your tax bracket and the length of time the asset was held. There's an additional 3.8% surtax on net investment income (nii) that you might have to pay on top of the capital gains tax.

Quick and easy guide on capital gains.

In this episode, we break down short term. If an asset has been held for longer than a year. Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index income from capital gains is classified as short term capital gains and long term capital gains. An aspect of fiscal policy. If you had purchased that same stock of your favorite company but. Requires only 7 inputs into a simple excel spreadsheet. Some or all net capital gain may be taxed at 0% if your taxable. There's an additional 3.8% surtax on net investment income (nii) that you might have to pay on top of the capital gains tax. Quick and easy guide on capital gains. 2020 has new capital gains taxing on long term holdings where an income less $40,000 pays 0% on capital gains, and anything income between $40,000 and appx $430,000 pays 15% on capital gains. Any profit or gain that arises from the sale of a 'capital asset' is a capital gain. Below, the percentage of taxes paid are listed on the left with the corresponding income on. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Your gains are not from residential property capital gains tax 2020. Any profit or gain that arises from the sale of a 'capital asset' is a capital gain.

Source: finmedium.com

Source: finmedium.com The capital gains tax rate for tax year 2020 ranges from 0% to 28%.

Source: www.fiphysician.com

Source: www.fiphysician.com 2020 has new capital gains taxing on long term holdings where an income less $40,000 pays 0% on capital gains, and anything income between $40,000 and appx $430,000 pays 15% on capital gains.

Source: housecashin.com

Source: housecashin.com Comparing capital gains tax proposals by 2020 presidential candidates.

Source: s10009.cdn.ncms.io

Source: s10009.cdn.ncms.io If you buy and sell investments, you need to know the capital gains basics or you are at risk of significant losses through bad tax planning, an irs.

Source: michaelsheaplanning.com

Source: michaelsheaplanning.com Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index income from capital gains is classified as short term capital gains and long term capital gains.

Source: impactcapllc.com

Source: impactcapllc.com Comparing capital gains tax proposals by 2020 presidential candidates.

Source: financialpress.com

Source: financialpress.com How capital gains are calculated.

Source: www.thestreet.com

Source: www.thestreet.com The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Source: g.foolcdn.com

Source: g.foolcdn.com Requires only 7 inputs into a simple excel spreadsheet.

Source: propertycashin.com

Source: propertycashin.com If you had purchased that same stock of your favorite company but.

Source: www.iwillteachyoutoberich.com

Source: www.iwillteachyoutoberich.com This long term capital gains tax on shares might probably discourage the investors.

Source: www.w9form2021.com

Source: www.w9form2021.com Capital gains tax is a levy on the difference between an asset's purchase price and sale price.

Source: static.toiimg.com

Source: static.toiimg.com Quick and easy guide on capital gains.

Source: cwoconner.com

Source: cwoconner.com How capital gains are calculated.

Source: blog.allindiaitr.com

Source: blog.allindiaitr.com Some or all net capital gain may be taxed at 0% if your taxable.

Source: alliancepllc.com

Source: alliancepllc.com Capital gain distributions are taxed at various rates.

Source: gruhasti.com

Source: gruhasti.com If you had purchased that same stock of your favorite company but.

Source: www.honoluluhi5.com

Source: www.honoluluhi5.com In this episode, we break down short term.

Source: www.livemint.com

Source: www.livemint.com It relies on the fact that money you lose on an investment can offset your capital gains on other investments.

Source: i.ytimg.com

Source: i.ytimg.com If you had purchased that same stock of your favorite company but.

Source: housecashin.com

Source: housecashin.com This long term capital gains tax on shares might probably discourage the investors.

Source: i2.wp.com

Source: i2.wp.com Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index income from capital gains is classified as short term capital gains and long term capital gains.

Source: i.pinimg.com

Source: i.pinimg.com How capital gains are calculated.

Source: financial1tax.com

Source: financial1tax.com Rates range from 0% to 37%, depending on your tax bracket and the length of time the asset was held.

Source: investorjunkie.com

Source: investorjunkie.com Quick and easy guide on capital gains.

Source: www.oksurugeneiyigelir.net

Source: www.oksurugeneiyigelir.net There's an additional 3.8% surtax on net investment income (nii) that you might have to pay on top of the capital gains tax.

Source: taxfoundation.org

Source: taxfoundation.org Some or all net capital gain may be taxed at 0% if your taxable.

Source: www.sportofmoney.com

Source: www.sportofmoney.com 2020 has new capital gains taxing on long term holdings where an income less $40,000 pays 0% on capital gains, and anything income between $40,000 and appx $430,000 pays 15% on capital gains.

Source: g.foolcdn.com

Source: g.foolcdn.com Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual fund, or bonds.

Source: moneyfromzero.com

Source: moneyfromzero.com The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Posting Komentar untuk "Long Term Capital Gains Tax 2020"